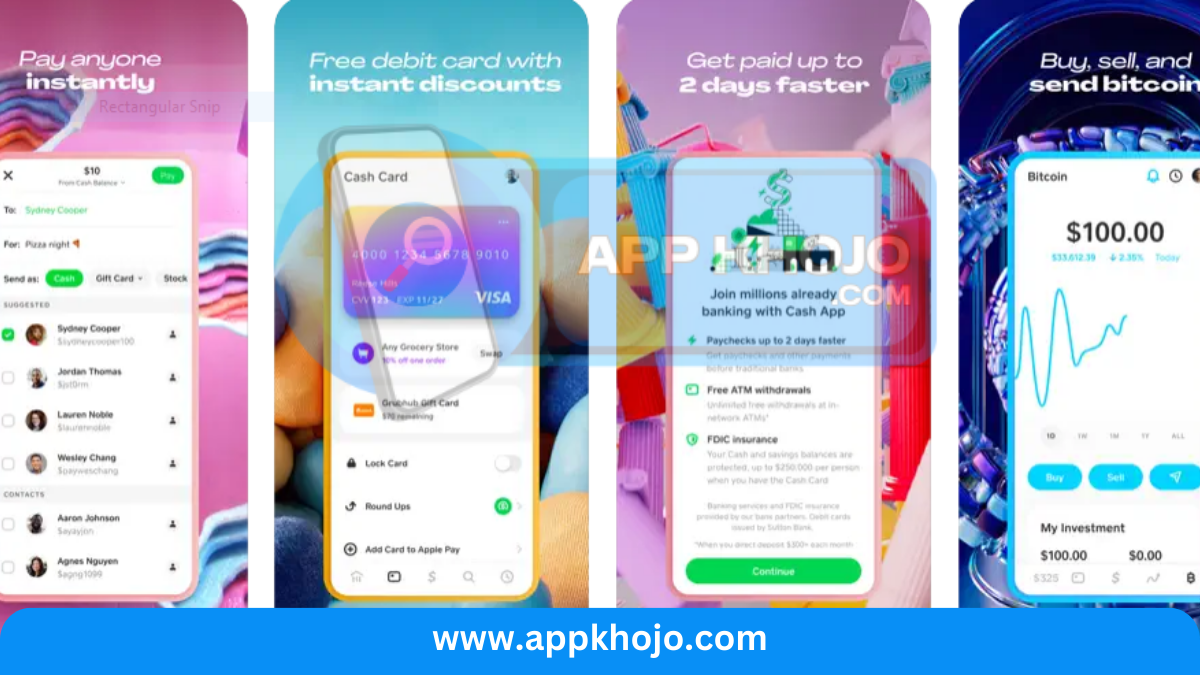

In today’s fast-paced digital age, managing your finances efficiently and securely is more crucial than ever. Enter Cash App, a versatile and user-friendly financial application that’s transforming the way people handle their money. Whether you need to send money to a friend, pay for your morning coffee, or invest in stocks, Cash App offers a comprehensive suite of features to cater to all your financial needs.

Join us as we dive into the world of Cash App, exploring its key functionalities, from peer-to-peer payments and investing to cashback rewards and Bitcoin transactions. We’ll uncover why Cash App has gained popularity as an all-in-one financial solution and how it’s simplifying everyday transactions. Say goodbye to the complexities of traditional banking and embrace the future of seamless and accessible financial management with Cash App.

Table of Contents

Key Features

1. Peer-to-Peer Payments:

- Cash App’s peer-to-peer payment feature serves as the cornerstone of its functionality. It streamlines the process of sending and receiving money among friends and family. This peer-to-peer payment system is not only convenient but also expeditious, allowing users to transfer funds instantaneously with the simple click of a button. Whether you’re splitting a dinner bill, reimbursing a friend for a concert ticket, or contributing to a group gift, Cash App eliminates the need for traditional cash transactions, checks, or bank transfers.

2. Cash Card:

- One of Cash App’s distinctive features is the Cash Card, a customizable debit card linked to a user’s Cash App balance. This financial tool bridges the divide between digital and physical spending. Users can request a physical card for in-store purchases and ATM withdrawals or employ a virtual card for online transactions. Beyond the standard payment functions, the Cash Card opens the door to exclusive cashback rewards on eligible purchases. This amalgamation of real-world and digital financial capability provides users with a flexible and rewarding payment experience.

3. Investing:

- Cash App’s investment feature makes stock trading accessible to a broad spectrum of users. It grants individuals the opportunity to invest in a multitude of publicly traded companies. This feature is especially attractive to novice investors who wish to venture into the stock market without grappling with the intricacies of traditional brokerage platforms. It’s a user-friendly entry point into the world of stock trading, enabling users to build a diverse investment portfolio with the brands they know and trust.

4. Bitcoin Transactions:

- For those intrigued by the world of cryptocurrencies, Cash App simplifies the process of buying, selling, and holding Bitcoin. This feature provides a user-friendly gateway into the realm of digital currencies. Users can invest in Bitcoin with confidence, knowing that they have a secure and straightforward platform at their disposal. Whether you’re a crypto enthusiast or a curious newcomer, Cash App’s Bitcoin functionality offers a straightforward way to explore the world of blockchain and digital assets.

5. Cash Boost:

- The Cash Boost program is a unique feature that gives users the ability to unlock exclusive cashback rewards and discounts when using their Cash Card. By activating a Cash Boost before making a purchase, users can enjoy savings at popular merchants. This feature empowers users to maximize their spending power and enjoy benefits on everyday expenses, whether it’s a discount on groceries, coffee, or transportation services. Cash App enhances your purchasing experience by giving you more value for your money.

6. Direct Deposit:

- Cash App’s direct deposit feature provides users with a convenient alternative to traditional banking. It enables individuals to receive their paychecks, government benefits, or tax refunds directly into their Cash App balance. This direct deposit functionality streamlines the process of accessing funds and reduces reliance on traditional bank accounts. Users can enjoy quick and hassle-free access to their finances, making it an appealing option for those seeking a more efficient approach to handling their money.

7. Security:

- Security is paramount in any financial application, and Cash App takes this responsibility seriously. The app incorporates robust security measures, including PIN protection, fingerprint recognition, and two-factor authentication. These layers of security help safeguard users’ accounts and sensitive financial information, providing peace of mind and ensuring a secure and confidential experience. Cash App prioritizes the protection of your financial data.

In conclusion, Cash App stands as a comprehensive financial application designed to streamline and enhance various aspects of personal finance. Its diverse range of features, including peer-to-peer payments, the Cash Card, investment and Bitcoin functionality, cashback rewards, direct deposit, and stringent security measures, all come together to create a user-friendly, all-encompassing financial ecosystem. Cash App empowers users to manage their finances, invest, and transact with ease, ultimately simplifying everyday financial interactions and bridging the gap between traditional banking and the digital age.

Using Cash App

Using Cash App is a user-friendly process that enables you to manage your finances and make transactions with ease. Here’s a step-by-step guide on how to use the app:

1. Download and Install Cash App:

- Begin by downloading Cash App from your device’s app store. It’s available for both iOS and Android. Once the download is complete, install the app as you would with any other application.

2. Sign Up or Log In:

- If you’re a new user, you’ll need to sign up for a Cash App account. This involves providing your email address or mobile phone number, creating a unique username (known as a $Cashtag), and setting a secure password. If you’re an existing user, simply log in with your credentials.

3. Link Your Bank Account:

- To send and receive money, you’ll need to link your bank account or debit card to your Cash App account. You can do this by providing your bank account details or card information. Cash App uses this information to facilitate transactions.

4. Send Money:

- To send money to someone, tap the “Pay” button. Enter the recipient’s $Cashtag, email, or phone number, along with the amount you wish to send. Confirm the transaction, and the money will be sent instantly to the recipient.

5. Request Money:

- If you’re owed money, you can request it through Cash App. Simply tap the “Request” button, enter the amount you’re requesting, and select the person you want to request money from. They’ll receive a notification and can easily fulfill your request.

6. Receive Money:

- When someone sends you money via Cash App, you’ll receive a notification. The money will be instantly added to your Cash App balance, which you can then transfer to your linked bank account.

7. Activate Your Cash Card (Optional):

- If you’d like to order a physical or virtual Cash Card, you can do so in the app. Once you receive your Cash Card, you can use it for payments and withdrawals, and it’s connected to your Cash App balance.

8. Invest in Stocks (Optional):

- Cash App offers an option to invest in stocks. You can explore available stocks, buy shares, and track your investments within the app.

9. Buy and Sell Bitcoin (Optional):

- If you’re interested in cryptocurrency, you can use Cash App to buy, sell, and hold Bitcoin. It provides a user-friendly way to get started with digital currencies.

10. Activate Cash Boost (Optional):

- Cash Boost offers cashback rewards on certain purchases made with your Cash Card. You can activate boosts to unlock discounts and savings at participating merchants.

11. Monitor Your Transactions:

- Cash App provides a transaction history that allows you to keep track of your financial activities, including payments, deposits, and withdrawals. This helps you stay organized and manage your finances effectively.

12. Set Security Options:

- To ensure the security of your Cash App account, you can enable features like PIN protection, fingerprint recognition, and two-factor authentication. These safeguards add an extra layer of protection.

13. Explore the App:

- Take the time to explore Cash App’s various features, including the ability to check your balance, view your linked cards and accounts, and manage your settings. You can also discover new services and functionalities that the app may offer.

Using Cash App, you can effortlessly handle your financial transactions, whether it’s sending money to friends, investing, buying Bitcoin, or enjoying cashback rewards. The app’s user-friendly design and diverse features cater to your financial needs and make managing your money a convenient and streamlined process.

Pros

- Convenience

- Speed

- Accessibility

- Customization

- Cashback

- Investment

- Bitcoin

- Security

Cons

- Fees

- Limits

- Dependency

- Support

- Privacy

- Volatility

- Learning

- Regulations

Q1: What is Cash App?

Cash App is a mobile payment service that allows users to send, receive, and manage money conveniently from their mobile devices. It also offers additional features like a Cash Card for spending and investing options.

Q2: How do I download and set up Cash App?

To get started, visit your device’s app store (iOS App Store or Google Play Store), search for “Cash App,” and download it. After installation, follow the on-screen instructions to set up your account, which includes linking a bank account or debit card.

Q3: Is Cash App secure to use for transactions?

Yes, Cash App employs security features like encryption, PIN protection, and identity verification to keep your transactions safe. Additionally, it has a dedicated support team to address any security concerns.

Q4: What can I use Cash App for?

You can use Cash App for a variety of purposes, including sending money to friends and family, making online purchases, paying bills, investing in stocks or Bitcoin, and even receiving your paycheck through direct deposit.

Q5: Are there fees associated with using Cash App?

While many of Cash App’s features are free, there are certain fees for services like instant transfers and withdrawing funds from ATMs. These fees are clearly outlined in the app.