In the fast-paced world of investments and stock trading, the HDFC Securities app stands as a beacon of financial empowerment. It’s more than just an app; it’s your gateway to the dynamic world of trading, investment, and wealth creation.

In this app review, we’re embarking on an exciting journey to explore the HDFC Securities app. It’s a comprehensive financial tool that places the stock market, mutual funds, and other investment avenues right at your fingertips.

Join us as we delve into the heart of HDFC Securities, uncovering its powerful features, from real-time trading to detailed market analysis. Discover how this app has simplified the complexities of investment, making it accessible to both seasoned traders and newcomers.

From the ease of use to the wealth of financial resources, HDFC Securities is poised to redefine how you approach your financial goals. It’s time to explore the world of investment with confidence and expertise, courtesy of HDFC Securities.

Are you ready to take control of your financial future? Look no further than HDFC Securities, your gateway to a world of investment opportunities. In this in-depth review, we’ll explore why HDFC is the ideal choice for anyone looking to grow their wealth and secure their financial independence.

Table of Contents

Key Features

1. Real-Time Trading:

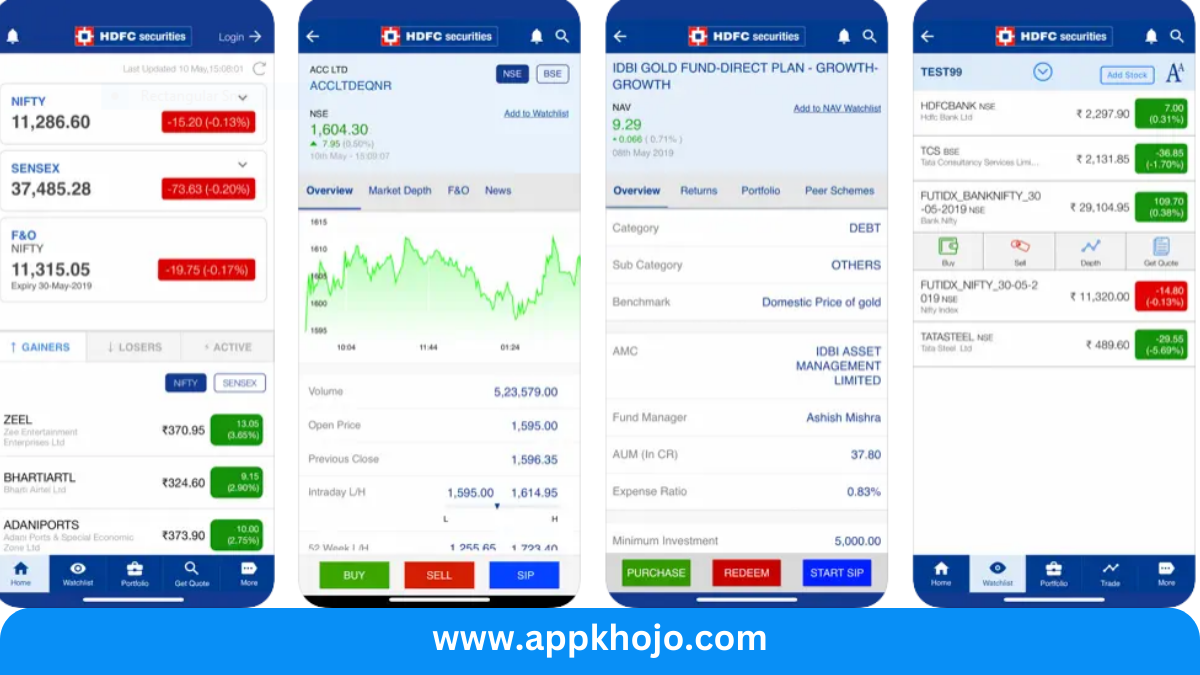

- The HDFC Securities app offers real-time trading capabilities, allowing users to buy and sell stocks, derivatives, and commodities instantly. It provides access to live market data, stock quotes, and real-time order placement.

- Analysis: Real-time trading is crucial in the stock market, and the app’s ability to deliver up-to-the-minute market information ensures that users can make informed decisions swiftly. This feature is invaluable for traders who thrive on timing and market dynamics.

2. Mutual Fund Investments:

- HDFC Securities enables users to invest in a wide range of mutual funds, offering a detailed overview of fund performance, historical data, and the ability to invest and redeem units easily.

- Analysis: Mutual funds are a cornerstone of modern investing, and HDFC Securities simplifies the process. This feature opens doors for users to diversify their portfolios and potentially build wealth through professionally managed funds.

3. In-Depth Market Analysis:

- The app provides comprehensive market research, including stock market news, expert analysis, market trends, and historical data. It equips users with the knowledge needed to make informed investment choices.

- Analysis: Knowledge is power in the financial markets, and HDFC Securities empowers its users with a wealth of information. By offering market insights, the app supports users in their decision-making process, enhancing their potential for success.

4. Customized Watchlists:

- Users can create personalized watchlists to monitor their favorite stocks, mutual funds, or investment portfolios. The app provides real-time updates on these assets.

- Analysis: Custom watchlists offer convenience and flexibility. Users can keep a close eye on assets that matter most to them, allowing for better portfolio management and quick decision-making.

5. Secure Transactions:

- HDFC Securities emphasizes security, implementing advanced encryption and multi-factor authentication to protect users’ financial data and transactions.

- Analysis: Security is paramount when dealing with investments and personal finances. The app’s commitment to protecting users’ data and financial transactions ensures that users can trade with peace of mind.

6. Customer Support and Resources:

- HDFC Securities typically offers robust customer support and resources, including guides, tutorials, and dedicated helplines to assist users with their investment queries and concerns.

- Analysis: Accessible customer support and educational resources contribute to user satisfaction. Users can seek help and gain knowledge to make informed decisions, especially if they are new to the world of investing.

In conclusion, HDFC Securities is more than just a trading app; it’s a comprehensive financial tool. Real-time trading and in-depth market analysis empower users to seize opportunities in the stock market. Mutual fund investments offer diversification, while customized watchlists enable efficient portfolio management. The app’s commitment to security and support ensures a user-friendly and secure investment experience. HDFC Securities is a valuable asset for traders and investors looking to thrive in the dynamic world of finance.

How To Use HDFC Securities

1. Download and Install:

- Begin by downloading the HDFC Securities app from your device’s app store. It’s available for both iOS and Android devices. Once the installation is complete, open the app.

2. Create an Account or Log In:

- If you’re a new user, you’ll need to create an account. Provide your personal details, including your PAN (Permanent Account Number), bank account details, and more. Existing users can log in using their credentials.

3. KYC (Know Your Customer):

- To comply with regulatory requirements, you may need to complete the KYC process. This involves verifying your identity and financial information. Follow the in-app instructions to complete the KYC procedure.

4. Explore the Dashboard:

- Once you’re logged in, you’ll find yourself on the app’s dashboard. This is the central hub for your stock market activities. You can navigate to different sections of the app from here.

5. Market Analysis:

- Dive into the world of market analysis by exploring real-time stock prices, market news, expert recommendations, and research reports. Familiarize yourself with the latest market trends and investment opportunities.

6. Trade Stocks and Derivatives:

- To buy or sell stocks, derivatives, or commodities, navigate to the trading section. Select the stock you wish to trade, enter the quantity and price, and place your order. The app offers options for intraday trading and delivery-based trading.

7. Mutual Fund Investments:

- Explore the mutual funds section to discover and invest in a wide range of mutual funds. Review performance data, read fund descriptions, and make your investment decisions.

8. Watchlists and Portfolio Management:

- Create personalized watchlists by adding your favorite stocks and funds. Monitor your portfolio’s performance and track real-time market data on the app.

9. Secure Transactions:

- Ensure you have a secure PIN or password set up to protect your account. The app employs multi-factor authentication and encryption for secure transactions.

10. Customer Support:

- If you have any questions or encounter issues, the app typically provides access to customer support through chat, email, or phone. Reach out to get assistance from experts.

11. Stay Informed:

- Keep yourself updated with stock market news, earnings reports, and notifications about your investments. Staying informed is key to making strategic decisions.

12. Monitor Your Investments:

- Regularly review your investment portfolio, check your order history, and track the performance of your holdings. You can also access account statements and tax-related documents.

By following these steps, you can use the HDFC Securities app effectively for trading, managing investments, and staying informed about the financial markets. Whether you’re a seasoned trader or a novice investor, this app provides the tools and resources needed for success in the world of finance.

Also, have a look at the Windows App

Pros

- Real-Time

- Diverse

- Secure

- Convenient

- Informative

- Responsive

Cons

- Complexity

- Fees

- Market

- Dependency

- Regulations

- Risk

1. What is HDFC Securities, and how does it work?

HDFC Securities is an online platform that allows you to invest in a wide range of financial instruments, including stocks, mutual funds, bonds, and more. It works by providing you with access to the financial markets, research tools, and expert insights to help you make informed investment decisions.

2. How to check nominees online?

To check the nominee, you can follow these steps:

Log into Your HDFC Securities Account: Go to the official HDFC Securities website and log in to your account using your User ID and password.

Navigate to the Profile Section: Once logged in, look for the “Profile” or “My Account” section. It is typically located in the top menu or the user dashboard. Click on it to access your account details.

View Nominee Information: Within the Profile section, you should find an option related to your nominee details. It may be labeled as “Nominee Information” or something similar. Click on this option to view the details of your nominee.

Verify Nominee Details: You will be able to see the name of the nominee you have registered for your HDFC Securities account, as well as their contact information and relationship with you.

Update or Make Changes (if necessary): If you need to make changes to your nominee information or update any details, there should be an option to do so within this section. Follow the prompts to make any necessary updates.

Save Changes: After reviewing or updating your nominee information, be sure to save the changes. This step is crucial to ensure that the updated information is recorded in your account.

Logout Securely: Once you have checked or updated your nominee details, log out of your HDFC Securities account securely to protect your personal and financial information.

Please note that the exact steps and labels may vary slightly depending on the HDFC Securities website’s interface and updates made to their online platform. If you encounter any difficulties or have specific questions about your nominee details, consider reaching out to HDFC Securities customer support for assistance.

3. Is my money safe?

The app places a strong emphasis on security. Your financial data is encrypted, and the platform implements stringent security protocols to safeguard your investments and personal information.

4. How to find client ID in HDFC securities?

To find your Client ID, you can follow these steps:

Log In to Your HDFC Securities Account: Go to the official HDFC Securities website and log in to your account using your User ID and password.

Access Your Profile or Account Details: After logging in, navigate to the “Profile” or “My Account” section. This section is typically located in the top menu or on your user dashboard.

Locate Client ID: Within the Profile or Account Details section, you should be able to find your Client ID listed. It may be labeled as “Client ID,” “Unique Client Code,” or something similar.

Note or Save Your Client ID: Once you locate your Client ID, make sure to note it down or save it for future reference. This ID is essential for various transactions and inquiries related to your account.

Logout Securely: After retrieving your Client ID, log out of your account securely to protect your personal and financial information.

If you cannot find your Client ID or encounter any issues while trying to access it online, consider reaching out to HDFC Securities customer support for assistance. They should be able to provide you with your Client ID or guide you on how to retrieve it.

5. What is DP ID in HDFC securities?

In HDFC Securities, a DP ID refers to a Depository Participant Identification Number. It is a unique code that identifies your specific Depository Participant (DP) within the Depository system in India. The DP ID is used for demat accounts, which are accounts that hold your electronic securities such as stocks, bonds, and mutual funds in a dematerialized or electronic form.

Here’s a breakdown of what the DP ID in HDFC Securities typically consists of:

DP Name: This is the name of the Depository Participant, in this case, HDFC Securities.

DP ID Number: This is a unique numerical code assigned to HDFC Securities as a DP. It helps identify HDFC Securities as a specific entity within the depository system.

Client ID: This is your unique identification number within HDFC Securities. It distinguishes your demat account from others held by HDFC Securities.

When you want to transfer or trade securities through your demat account with HDFC Securities, the DP ID is used to ensure that the correct demat account is credited or debited. It’s an essential part of the dematerialization process in India’s financial markets and helps maintain the integrity and security of electronic securities transactions.