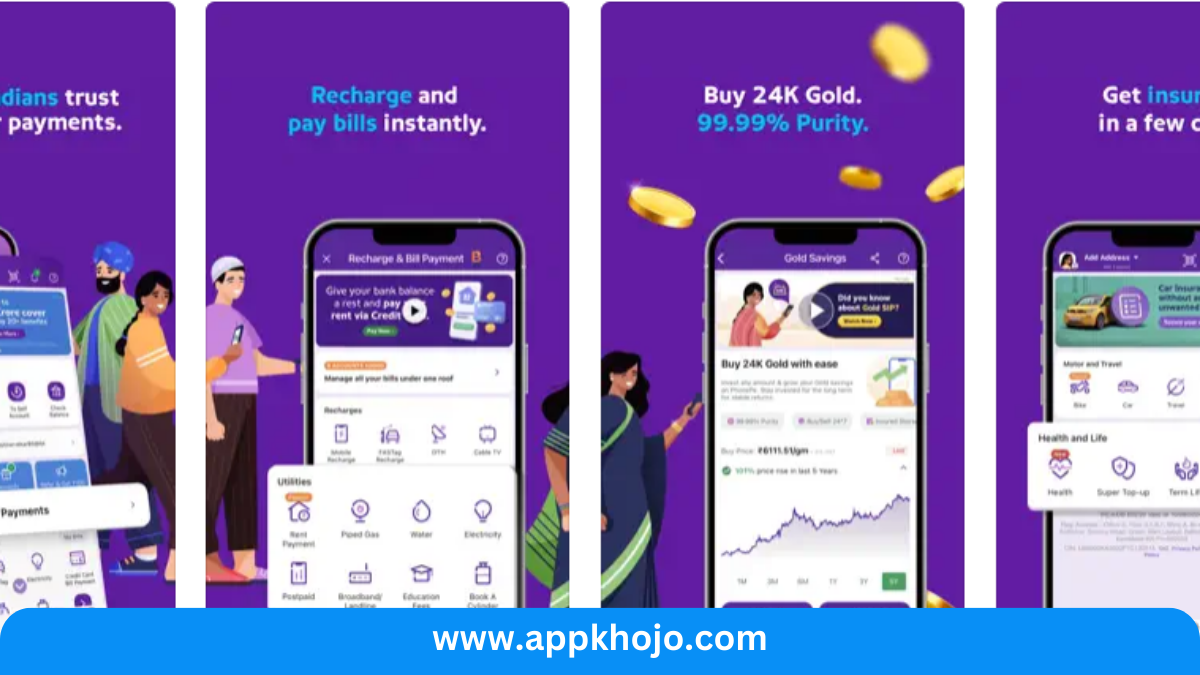

In a world where digital transactions have become the norm, PhonePe emerges as a versatile financial companion, offering a spectrum of services within the palm of your hand. It’s not just an app; it’s a portal to a seamless and secure financial experience.

In this app review, we embark on a journey to explore PhonePe, uncovering its multitude of features that make it a frontrunner in the world of mobile payments and digital banking. Whether you’re looking to send money, pay bills, shop online, or invest in mutual funds, PhonePe brings a multitude of financial tools right to your fingertips.

Join us as we delve into the heart of PhonePe, discovering how it simplifies your financial life, streamlines transactions, and ensures your money is always at your command. This app has revolutionized the way we manage our finances, and we’re about to see why.

From mobile recharges to secure UPI transactions, PhonePe is the financial Swiss Army knife you’ve been waiting for.

In the fast-paced digital age, having a reliable and user-friendly digital payment platform is essential. PhonePe app download, a leading player in the digital payment landscape, offers a seamless and secure way to handle your financial transactions. In this article, we’ll delve into what sets PhonePe apart and how it simplifies your financial interactions.

Table of Contents

Key Features

1. Unified Payments Interface (UPI):

- PhonePe is a UPI-based app, that allows users to link their bank accounts and perform instant money transfers to other individuals or businesses. UPI is renowned for its real-time, secure, and convenient money transfer capabilities.

- Analysis: PhonePe’s UPI integration simplifies peer-to-peer transactions and eliminates the need for traditional bank transfers. It provides a seamless experience for sending money, making payments, and splitting bills, transforming digital payments in India.

2. Mobile Recharges and Bill Payments:

- Users can conveniently recharge their mobile phones, pay utility bills, and make payments for a variety of services within the app. It covers electricity, water, gas, and more.

- Analysis: This feature saves users the hassle of standing in long queues or logging into different portals for bill payments. It streamlines the process, ensuring that payments are made promptly, thereby avoiding late fees and disruptions to essential services.

3. Shopping and Merchant Payments:

- PhonePe allows users to shop on a variety of e-commerce platforms and pay for purchases directly through the app. It also supports payments at physical retail stores through QR code scanning.

- Analysis: This feature enhances the app’s versatility, making it an all-in-one tool for both online and offline transactions. Users can enjoy the convenience of secure transactions while shopping, all from a single platform.

4. Mutual Fund Investments:

- PhonePe offers an integrated platform for investing in mutual funds. Users can explore a range of funds, compare their performance, and make investments with ease.

- Analysis: The inclusion of mutual fund investments brings financial planning within reach for users. It’s a valuable feature for those looking to grow their wealth through smart investments.

5. Digital Gold Purchase:

- Users can buy and store digital gold within the app. This allows for easy investment in gold without the need for physical storage.

- Analysis: Digital gold purchase is a smart way to diversify one’s investment portfolio. It offers a secure and flexible means of investing in a precious metal that has traditionally been a store of value.

6. Insurance Premium Payments:

- PhonePe enables users to pay insurance premiums, including health, life, and motor insurance. This simplifies the management of insurance policies.

- Analysis: This feature ensures that users never miss an insurance premium payment, which is crucial for policy continuity. It adds an extra layer of convenience to financial planning.

7. Security and Privacy:

- PhonePe places a strong emphasis on security and privacy, employing advanced encryption and authentication measures to protect users’ financial data.

- Analysis: In a digital age where security is paramount, PhonePe’s commitment to user protection builds trust and confidence. Users can transact with peace of mind, knowing their sensitive financial information is secure.

In conclusion, PhonePe offers a comprehensive suite of financial services that cater to the diverse needs of its users. The UPI integration simplifies money transfers, while mobile recharges and bill payments streamline financial responsibilities. The ability to shop, invest in mutual funds, and buy digital gold adds layers of financial convenience, all under one roof. Furthermore, the emphasis on security and privacy assures users that their financial data is in safe hands. PhonePe has not only simplified digital payments but has also redefined the way people manage and grow their finances in India.

How To Use PhonePe

Using the PhonePe app is a straightforward process, designed to make digital transactions and financial management convenient. Here’s a step-by-step guide on how to use PhonePe:

1. Download and Install:

- Start by downloading the PhonePe app from your device’s app store (available for both iOS and Android). Once the installation is complete, open the app.

2. Sign Up or Log In:

- If you’re a new user, you’ll need to sign up for a PhonePe account. This usually involves entering your mobile number, verifying it with an OTP (One-Time Password), and creating a secure PIN. If you’re an existing user, simply log in with your credentials.

3. Add a Bank Account:

- Link your bank account(s) to the app. This step is crucial for performing transactions. PhonePe supports a wide range of banks.

4. Set Up Your UPI ID:

- Create your UPI (Unified Payments Interface) ID, which will serve as your digital payment address. This ID typically looks like “yourphonenumber@upi.”

5. Fund Your Wallet:

- You can load money into your PhonePe wallet or link it directly to your bank account. Loading money into your wallet provides a convenient way to make transactions.

6. Make Payments:

- Use PhonePe to send money to contacts or make payments to merchants. You can enter the recipient’s UPI ID, mobile number, or simply scan a QR code. The app supports person-to-person payments, bill payments, and more.

7. Recharge Mobile and Pay Bills:

- You can recharge your mobile phone, pay utility bills, credit card bills, and other services directly through the app. Simply select the respective service and follow the prompts.

8. Shop Online:

- Explore the “Apps” section of the app to shop on various e-commerce platforms. You can also enjoy exclusive offers and discounts.

9. Invest in Mutual Funds:

- Navigate to the “Invest” section to explore mutual funds and start investing. You can compare funds, track their performance, and invest with ease.

10. Buy Digital Gold:

- If you’re interested in purchasing digital gold, PhonePe provides a dedicated section for this. You can buy, store, and sell digital gold as an investment.

11. Manage Financial Instruments:

- Use the app to manage various financial instruments, including insurance policies and your investment portfolio.

12. Review Transactions:

- Keep track of your transactions and review your transaction history within the app. It provides a summary of your payments, investments, and more.

13. Security and Privacy:

- Ensure you set a secure PIN for the app and follow best practices for privacy. PhonePe emphasizes security, but taking precautions is always advisable.

By following these steps, you can efficiently use PhonePe for a wide range of financial transactions and services, simplifying your financial life and making digital payments hassle-free.

Also, have a look at Windows App

Pros

- Convenient

- Secure

- Versatile

- Efficient

- Time-saving

- Innovative

Cons

- Dependent

- Connectivity

- Fees

- Competition

- Complexity

- Privacy

1. What is PhonePe app download, and how does it work?

PhonePe is a digital payment platform that allows you to make payments, transfer money, pay bills, and even invest using your smartphone. It works by securely linking your bank account, debit or credit card to the app, enabling seamless transactions

2. Is the app download safe and secure?

Yes, it places a high emphasis on security. The platform uses advanced encryption technology and multi-layered security measures to protect your financial data and transactions. You can trust the app for safe and secure digital payments.

3. What types of transactions can I perform?

It offers a wide range of transaction options. You can make peer-to-peer payments, pay utility bills, recharge your mobile phone, shop at online and offline merchants, and even invest in mutual funds and digital gold.

4. How to change UPI Pin?

To change your UPI (Unified Payments Interface) PIN in the PhonePe app, follow these steps:

Open PhonePe App: Launch the PhonePe app on your smartphone. Ensure that you are logged in with the mobile number linked to your bank account and UPI.

Access Bank Accounts: Tap on the “Bank Accounts” or “My Money” option. This option is usually located on the app’s home screen or in the main menu.

Select Your Bank Account: From the list of linked bank accounts, select the bank account for which you want to change the UPI PIN.

Manage Account: Within your selected bank account, you will find options to manage your account. Look for an option like “Change UPI PIN” or “Set/Change UPI PIN” and tap on it.

Verify Identity: To change your UPI PIN, you will need to verify your identity. This typically involves entering the current UPI PIN.

Set a New UPI PIN: Once your identity is verified, you will be prompted to set a new UPI PIN. The new PIN should be a 4 or 6-digit number that is different from your previous PIN. Enter the new UPI PIN.

Confirm New UPI PIN: You will be asked to confirm the new UPI PIN by entering it again.

Verification: PhonePe may send an OTP (One-Time Password) to your registered mobile number for additional security. Enter the OTP when prompted.

UPI PIN Changed: After successfully entering the OTP and confirming your new UPI PIN, you should receive a confirmation message that your UPI PIN has been changed.

Remember the New UPI PIN: Ensure you remember the new UPI PIN you’ve set, as it will be required for future transactions.

Please note that the exact steps and options may vary slightly depending on the version of the PhonePe app and updates made to the interface. If you encounter any issues or have difficulty changing your UPI PIN, you can reach out to PhonePe customer support for assistance.

5. How to reset the UPI Pin?

To reset your UPI (Unified Payments Interface) PIN in the PhonePe app, you can follow these steps:

Option 1: Reset UPI PIN Within the PhonePe App

Open PhonePe App: Launch the PhonePe app on your smartphone. Make sure you are logged in with the mobile number linked to your bank account and UPI.

Access Bank Accounts: Tap on the “Bank Accounts” or “My Money” option. This option is usually located on the app’s home screen or in the main menu.

Select Your Bank Account: Choose the bank account for which you want to reset the UPI PIN.

Manage Account: Within the selected bank account, you will find options to manage your account. Look for an option like “Reset UPI PIN” or “Forgot UPI PIN” and tap on it.

Verify Identity: To reset your UPI PIN, you will need to verify your identity. This usually involves entering your debit card details, including the card number and expiration date.

Set a New UPI PIN: After verifying your identity, you will be prompted to set a new UPI PIN. Enter the new UPI PIN, which should be a 4 or 6-digit number.

Confirm New UPI PIN: You will be asked to confirm the new UPI PIN by entering it again.

Verification: PhonePe may send an OTP (One-Time Password) to your registered mobile number for additional security. Enter the OTP when prompted.

UPI PIN Reset: After successfully completing the steps and entering the OTP, you should receive a confirmation message that your UPI PIN has been reset.

Remember the New UPI PIN: Be sure to remember the new UPI PIN you’ve set, as it will be required for future transactions.